Krugman

The September 15 Paul Krugman analyzed the macroeconomic situation of the United States

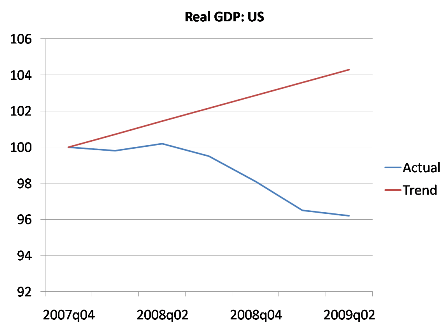

First we look at how deep the pit where we are. Instead of going into the details of the calculations necessary to measure the output gap, let me present a very simple calculation: to compare the GDP, as the recession began, with what would have been if the economy had continued to grow along its trend (1999 to 2007 )

Quindi siamo circa un otto per cento sotto a quello che dovrebbe essere. Questo si traduce in una perdita di produzione ad un tasso di più di mille miliardi di dollari all’anno (ed anche in disoccupazione di massa). E continueremo a soffrire queste perdite, anche se il PIL sta ora crescendo, fino a quando avremo abbastanza crescita per chiudere quel gap. Siccome non c’è nulla nei dati che suggerisca che il gap si sta chiudendo, questa è una tragedia che continuerà.

Che cosa vuol dire il professor Krugman (ma anche tutti i keynesiani)? Prendo in prestito il modello che Garrison used in Time and Money (borrowed from Leijonhufvud ) to explain what Keynes argued in his General Theory.

Keynes

distributed by Keynes's conclusions on the origins of the business cycle:

" Now, we have been used to explain the crisis to emphasize the trend of the interest rate to rise under the influence of increased demand for money or as an intermediary in trade for speculative reasons. Sometimes this factor può certamente avere un ruolo aggravante e, forse occasionalmente, di scintilla. Ma suggerisco che una più tipica e spesso predominante spiegazione della crisi non è da ricercare nel rialzo del tasso di interesse ma nell’improvviso collasso dell’efficienza marginale del capitale »

Vediamo ora, servendoci da questo grafico riassuntivo, di capire che cosa significa.

Prima della crisi

L’economia si trovava al punto A. Vediamo brevemente che cosa ci indicano i sei pannelli (la lettera D indica la domanda aggregata mentre

Pannelli 1,2,3 – Mercato del lavoro e reddito aggregato

Nel punto di piena occupazione vengono impiegate 20 ore di lavoro al salario nominale di 10$ l’ora (pannello 1), per un reddito totale da lavoro dipendente pari a 200$ (pannello 2). Poiché Keynes (Teoria Generale) sosteneva che « i costi dei fattori produttivi hanno un constant relationship with the wage , "we can assume (panel 3) that the total income to be in constant contact with the earnings (in our case $ 300 / $ 200, or 3 / 2).

Panel 4 - Total expenditure

The panel 4 is the heart of his analysis and the Keynesian circular flow model . The cost of one's income to another, and then aggregate expenditures are equal to the aggregate income. What are the components of aggregate expenditure?

There are consumption (regular member), which depend on the income through what Keynes called the propensity to consume (in practice, if our propensity to consume is 0.6, for every $ 100 we receive we will spend $ 60) and investments (volatile component) which do not depend on income, but only by expectations of the future. In our case the level of consumption is $ 210 with investment of $ 90.

Panel 5 - Production Possibility Frontier

Normally this figure is omitted macroeconomic analysis but it is very important because it shows what are the production levels sustainable by the economy. According to Keynesian analysis, before the onset of the crisis, the economy went along the production possibility frontier .

Panel 6 - The market for loanable funds

This panel, finally, correlates demand and supply of loanable funds, which correlates the savings (Savings ) with investment ( Investments) through the interest rate market.

comes the crisis

As we wrote previously Keynes identified the cause of the crisis mainly to a sudden collapse of the marginal efficiency of capital, then aggravated by increased interest rates due to increased demand for money (higher liquidity preference) .

"Back to what happens at the beginning of the crisis. As long as the boom continued, many of the new investment is not shown to have a current yield is not satisfactory. The disillusion comes because doubts suddenly arise concerning the plausibility of future performance, perhaps because the current yield shows signs of decline as the stock of new durable goods increases. If you think that the current production costs are higher than they will in the future, then there is another reason for a drop in the marginal efficiency of capital. Once the doubts arise then spread rapidly. So at the beginning of the recession will be very capital whose efficiency has become zero or even negative. " (Keynes, General Theory, cap.22)

the chart this movement is reflected in a leftward shift of investment demand from D to D 'which means that a level of investment I' less than full potential. Since then, wages have, in the Keynesian rigid downwards, the demand for labor also shifts from D to D 'and the new level of employment (which is not at the meeting point between supply and demand) is of only 15 hours instead of 20. It should be noted that even if wages were allowed to decrease the level of employment would be lower than pre-crisis. The lower income means that the supply of credit to move to the left from S to S ', leaving unchanged the initial interest rate.

we can finally see how the economy has declined in the production possibility frontier (there are closures, supply chains still, etc.)..

will take over then the aggravating factor, ie the increase in liquidity preference

"Besides the dismay and uncertainty about the future that accompany a collapse of the marginal efficiency of capital as they natural consequence of a sharp increase in liquidity preference, and therefore an increase in the rate of interest. So the fact that a collapse of the marginal efficiency del capitale tenda ad essere associato con un aumento del tasso di interesse può seriamente aggravare il declino degli investimenti» (Keynes, Teoria Generale, Cap. 22)

La curva di offerta di credito si sposta ulteriormente verso sinistra al livello S’’. Questo si traduce in un aumento del tasso di interesse ed in un livello di investimenti I’’. Il risultato è un aggravarsi della situazione che si stabilizza solo al punto B.

Il gap nella produzione di cui parlava Krugman è rappresentato dalla distanza tra i due punti A e B .

The Keynesian solution is to "fill" this gap through a coordinated monetary and fiscal policy. First, monetary authorities must neutralize the flight to liquidity through the availability of money through the credit market (ΔMc) and then bring the interest rate at pre-crisis level (blue arrow).

"If a reduction in the rate of interest alone would be able to be an effective remedy would then be able to get a shot quickly under control, more or less effective, the monetary authorities . But this is not what usually happens. " (Keynes, General Theory, Cap.22)

must then take the public authority which, through a level of spending G (so called "stabilizer") is to bridge the gap and bring the economy At the point of full.

seems in practice that public spending and debt are the solutions to the crisis. But this analysis is correct? How do spending and debt to be both causes of the crisis and their solution? To understand this we must return to what had happened before the crisis, during the boom.

Hayek

The Austrian business cycle theory explains that the boom is caused by an expansionary monetary policy that lowers the interest rate below its natural level. As the price system is the way in which the market signals the information to their players and since the interest rate the price is certainly more important than the economy, since it allows for the coordination of production over time, the intervention of the authorities currency has destructive consequences.

Let's see what happens to the production system (which we assume to be on the frontier of possibilities production) when the banking system entered into the new currency of ΔM in the form of credit. First, we note that in the Saving-Investment Panel, the supply of credit shifts to the right, intersecting the demand curve at point A, which corresponds to a lower interest rate (the '<>

Let's see what are the reactions of households and entrepreneurs.

For families the interest rate also indicates the opportunity cost they receive when they choose to consume today or save and buy in the future. If it is very low which means that very little incentive to consume and to save money (interest on current accounts are low, the titles "safe", make it and so on). An expansionary monetary policy to temporarily change time preferences of consumers and moving towards an early consumption, often financed by debt: the so-called consumerism. In the graph we see this trend by noting that the rate 'families, who still follow the S-curve, save less and therefore consume more (blue arrow on the panel of the production possibility frontier).

entrepreneurs is rather the opposite. If

increases the credit available, they are thinking, this is a signal that consumers are saving, and therefore will be inclined to increase their consumption in the future, so there is room to increase future production. In addition, a low interest rate makes a number of attractive investment, especially long-term , which was previously disadvantaged.

If the credit expansion increases the amount of money available, lowering the interest rate on loans to pay down the quality of the investment. In summary, not only will expand the claim beyond the bounds of real savings ( overinvestment), but it is also directed to speculative and risky activities that have little chance of success ( malinvestment ). The production possibility frontier we can see the 'overinvestment (the blue arrow, while the triangle shows the malinvestment Hayek (elongation time of the production structure)

The level of consumption and investment that manifested during the boom, represented in the graph from point A, is not all along the production possibility frontier , but beyond it, and then is not a sustainable for the economy.

The excesses and distortions that have occurred during the boom are not without consequences. The new production possibility frontier, in fact, not only in the point A (it is not represented by the dashed red curve), but neither is it more than you had at the beginning of the boom (the blue curve). In reality we can not say much about its location but recommends that the Austrian school is that you try to stop the liquidation of bad investments because only in this way the economy can find its sustainable structure and start over.

Conclusions

the light of Hayek's analysis is wrong and harmful you want to close the productivity gap and try to bring the economy to the sounds of fiscal and monetary stimulus, to the levels it had before the onset of the crisis (and then back to point A). Not only prevents the market to rediscover what is its efficient production structure, but will inevitably continue to waste its resources in those productive activities that have developed during the boom, in an unsustainable way, further worsening the overall situation.

An example is the automobile market: the 2006-2007 period has seen a boom in car sales (stimulated by scrapping and easy credit). And 'maybe lawful and reasonable to consider the record production level of 2007 as the target to be achieved and made permanent to the sound of subsidies, incentives and scrapping force (think of driving restrictions for cars older)?